Investors expect a fair return on their investments. If one investment does not seem to offer a high enough potential return, an investor can make the choice to take their investment money elsewhere.

The problem becomes that instead of buying a diversified basket of stocks, bonds, mutual funds & ETFs and holding for the long term, some investors frequently buy and sell, hoping to cash in on the latest hot investment.

This tactic seldom works in the long run.

Many of these investors look in the rearview mirror when they make their decisions on what stocks to purchase – chasing after investments that have recently performed strongly, on the assumption (and hope) that these investments will continue to rocket skyward.

But chasing returns, especially by going after the strongest performing investments, can put an investor at substantial risk.

What is the danger?

The danger is that you catch the stock at its peak when it is beginning to cool off – or worse – right before it enters a downward spiral.

You probably have heard that the goal of investing is to buy low and sell high. Chasing that high-flying, hot stock can lead you to end up buying high, with the prospect of having to sell low if the stock runs out of steam.

Even though the stock market as a whole has proven to be a good long-term investment, picking individual stocks is a risky endeavor.

That is why it may be better to invest in a well-balanced, diversified portfolio of funds and ETFs, which can give you diversification, and exposure across multiple sectors and asset classes.

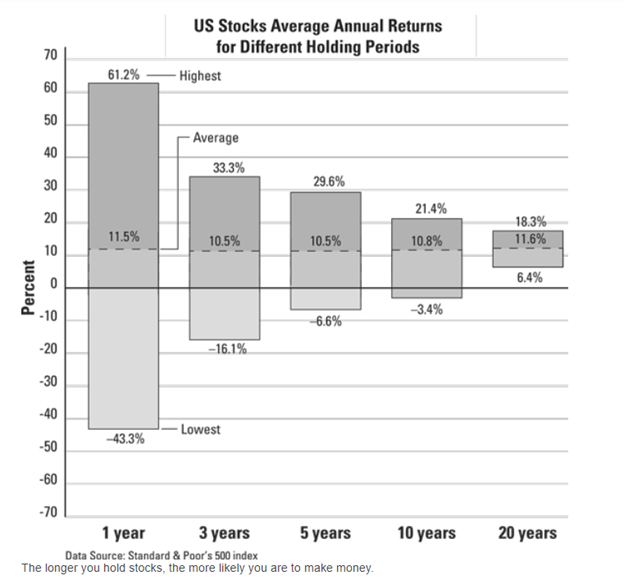

If you are willing to have a little patience and take a long-term outlook, there is not much reason to jump around from investment to investment, trying to hit the big winner. Over time, investing in a broad-based portfolio is a likely to be a big winner!

A tremendous amount of data exists regarding stock market returns. In fact, in the US markets, data going back more than 2 centuries documents the fact that stocks have been a terrific long-term investment.

And the long-term returns from stocks that investors have enjoyed have been remarkably consistent from one generation to the next.

Going all the way back to 1802, the US stock market has produced an annual return of about 8%, while inflation has averaged around 1.5%.

Thus, after taking inflation into consideration, the US stock market has appreciated about 6.5% faster annually than the rate of inflation, consistently (and substantially) beating the rate of inflation over the years.

Stocks are terrific investments to hold over the long term, but they have more volatility than bonds, treasury bills, and insurance products. A balanced portfolio gets you most of the long term returns of stocks and helps to create a buffer against volatility.

For professional money management, I recommend our team at Brookstone Capital Management. With over $6.5B in assets under management, Brookstone was recently named the #1 Fastest-Growing RIA by Financial Advisor Magazine.

As an Investment Adviser Representative, I find incredible joy and satisfaction in working with people to help them identify goals, manage risks, and achieve the type of long-term results they are looking for. For more information, feel free to contact me using the information below.

Ronald A. Sneller, Jr. FICF, FSCP®, RICP®, RFC®

Registered Financial Consultant

Investment Adviser Representative

Ron Sneller is a fee-based financial consultant. A veteran of the financial services business for 10 years, he has helped clients with their mortgages, insurance, investments, and retirement planning during that time.

Through education, empowerment, and action, Ron helps his clients take back control of their financial life to give them more clarity, focus, and security. You can reach him at: ronald.sneller@snellerfinancial.com

Comments are closed