How is it that hundreds of thousands of Americans each year find themselves at retirement age without the necessary funds to be able to retire?

What happened here? Who’s at fault?

Was it because of their upbringing? Their schooling? The government?

Many people go to school, get a job, work 40 years, and then retire…

Temporarily.

But since they can’t afford to live… they end up back at work as a greeter at Wal-Mart or flipping burgers at McDonald’s.

“Do you want fries with that?”

Okay, so maybe I’m exaggerating a bit, but many people find themselves worrying about money during a time period that’s supposed to be their “Golden Years.”

Why? A lack of planning.

This lack of planning is one of the biggest financial landmines I’ve seen in my 10 years in the financial services industry.

Few people ever stop long enough during the hustle & bustle of everyday life to ask some important questions, such as:

- How much money will I need to retire?

- At what age do I want to retire?

- And how much money will I need to save month-to-month to get there?

Don’t make that mistake!

It’s easy to throw around a number like “I need a million dollars” because most people have no idea just how much they’d have to save to accumulate that much.

Let me ask you, right now, at 8% interest, how much would you have to save every month to accumulate a million dollars in 30 years?

And then, what will a million dollars actually be WORTH in 30 years, with the way the government is inflating the heck out of the money supply?

And how much will you actually be able to withdraw from the account safely on a monthly basis? And how will taxation of those withdrawals affect the picture?

Society trains us not to know.

Society trains us not to know.

In fact, society trains us not to care.

They train us to spend, spend, spend.

And once the money is gone, pull out the plastic and spend some more!

Most people give their attention and effort to how much they’re going to spend – not how much they’re going to SAVE.

Or if they DO save, their only plan is to sock away whatever is left over once the bills are paid.

The problem? There is rarely anything left over – regardless of if the person is making $20,000 a year or $200,000 per year.

What’s wrong with this picture?!

Most Americans don’t have a plan. Remember, most people don’t plan to fail, they simply fail to plan.

As a country, we have lost the art of saving. It’s almost become un-American and un-Patriotic. We see a toy and we buy it; we drive by a bigger house, and we get it; we envy our neighbor’s car, so we duplicate it (or buy one even better!)

Maybe you find yourself losing the savings battle because you don’t have a plan.

What can you do? The answer is simple; not easy, but simple – build one! I’d like to offer some very practical steps that you can follow to improve your financial life.

Step 1: Set a Goal

Decide how much money you think you’ll need (or want) to accumulate and how many years you have to reach that goal.

For instance, if you are currently 35 years old, and you want to build a nest egg of $1.5M by age 65, how much would you need to save each month, if you could net 8% true average rate of return?

The answer might shock you… it’s just over $1,000 / mo.

The key is to get started as early as possible and let time work for you.

You may have no idea what to expect, or what’s realistic, so my recommendation is to talk with a financial professional about your goals and setting up a plan. (I know a good advisor if you need one – hint, hint).

Step 2: Pay Yourself First

Now how are you actually going to find that money in your budget to put away for your future?

For many people, there is usually more month than money… so if you’re maxed out, you may be wondering where the money is going to come from.

The answer is again simple, but not easy, that’s why so few people follow it.

Pay yourself first.

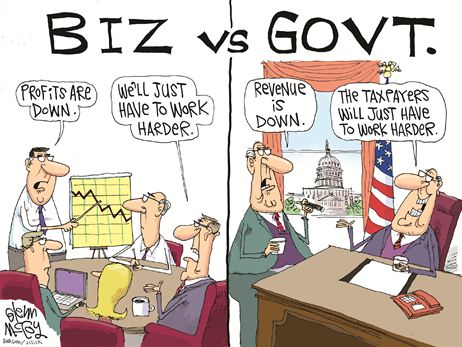

Who is the first person to take any money from your monthly income? Uncle Sam, of course. He never misses. No matter how much or how little you make, he always gets his cut.

Why? He gets paid first.

How well would it work if Uncle Sam said “Go ahead and pay all of your bills and obligations, buy your concert tickets and fund your vacations. Then at the end of the month, send us whatever you have leftover.”

One thing is for sure, we’d have fewer politicians!

Whatever the government might be, they’re not dumb. They know full well that if they waited to get their cut, their work would be in desperate danger. There would be nothing left over for them, just as there may be nothing left over for you right now.

And what do you do to compensate for this reduction in your income, compliments of the IRS? You adjust your standard of living to fit within the amount that is left after taxes (well, hopefully, that’s what you do).

So, people pay taxes, and pay them out of the first dollars they earn. Why do you treat the Internal Revenue Service better than you treat yourself?

Intentionally, you don’t, it’s just that you don’t think of it in those terms.

The key to savings success is to start doing what the government so kindly does for you. Set aside a % of your income and save it right off the top. I would recommend you start by saving at least 10% and save it right off the top.

Make it the #1 priority in your budget, and then adjust your standard of living as needed.

10% may seem like an impossible amount, but it isn’t. In fact, you may be surprised that you don’t even miss it.

At least that much money slips through people’s fingers each and every month on things like lattes, fast food, trinkets, and other junk purchases that they don’t actually need.

Why?

Simply because the money is there, begging to be spent.

If you take it away first, create a false sense of scarcity, I don’t believe that you’ll really lessen your standard of living all that much; you’ll just reduce the number of goodies that you’ll need to sell at your next garage sale.

When you are tempted to spend from your newfound savings, or to fudge the numbers – don’t!

Pretend your investment money is just as impossible to reach as those income taxes you pay to Uncle Sam each and every month.

If things are truly tight, plan and budget around this newly reduced amount. It may mean you have to re-evaluate and cut out something that’s not a necessity, but you’ll be better for it.

Author Patrick Kelly has this motto: “It’s a lot easier to spend money that you’ve over-saved than it is to save money that you’ve over-spent.”

Step 3: Start Today and Be Consistent

Last step, very simple; start today and don’t waver.

Last step, very simple; start today and don’t waver.

This is where discipline is very important.

And this is where having a goal and a burning desire to reach your financial goals is also important – to keep you on track when you see shiny objects that you’d like to spend all of your money on.

This is where hiring a financial consultant like myself can be a real help.

I can help create a road map for you to get you from where you are now to where you want to go.

I can help organize your savings, insurance, and investment program, to help bring clarity to where your hard-earned dollars should go, and in the proper amounts and ratios.

And while financial success doesn’t happen overnight, just think of the progress that you’ll see even a year or two from now.

And the thing that I love about progress – in any area of life – is that snowball effect. The power of compounding is amazing.

If you think you’ve made great progress in one year; think about what you can do in five years, or 10 years.

It’s often been said that people greatly overestimate what can be accomplished in one year; but greatly underestimate what can be accomplished in 5 years.

So, get started today!

Set a goal, pay yourself first, and stick to plan…

You’ll be amazed at where you’ll end up in just a few short years!

Ron Sneller is a fee-based financial consultant. A veteran of the financial services business for 10 years, he’s helped clients with their mortgages, insurance, investments, and retirement planning during that time.

Through education, empowerment, and action, Ron helps his clients take back control of financial life to give them more clarity, focus, and security.

Comments are closed